Attend asf2024 in order to meet the leaders in the actuarial science and finance and keep abreast of all advances in the field.

12th Conference in Actuarial Science & Finance on Samos

The Department of Statistics and Actuarial – Financial Mathematics of the University of the Aegean is pleased to host the 12th Conference in Actuarial Science & Finance on Samos

12th Conference of Actuarial Science and Finance

May 20-25 2024, Karlovasi, Greece

The Department of Statistics and Actuarial – Financial Mathematics of the University of the Aegean is pleased to host the 12th Samos Conference in Actuarial Science and Finance, to be held on May 20 – 25, 2024. This event, jointly organized with the Katholieke Universiteit Leuven, the Kobenhavns Universitet and New York University provides a forum for state-of-the-art results in the areas of insurance, finance and risk management. The meeting is open to people from Universities, Insurance Companies, Banks, Consulting Firms and Regulatory Authorities.

Topics

- Stochastic Models in Non-Life Insurance (Chair: Hansjoerg Albrecher)

- Financial Theory and Practice (Chair: Jan Obłój)

- Actuarial and Financial Data Analytics (Chair: Jose Blanchet)

- Life, Health and Pension Insurance (Chair: Mogens Steffensen)

- Emerging Risks: Climate, Cyber, Pandemics (Chair: Holger Drees)

- Risk Management (Chair: Zinovyi Landsman)

Days

Invited Speakers

Presentations

Universities

Topics

Why to attend?

Participate

Participate in asf2024 in order to present your own research achievements and accomplishments and gain insight or new ideas from colleagues from Universities, Insurance Companies, Banks, Consulting Firms or Regulatory Authorities, interested in actuarial-financial mathematics.

Invited Speakers

eisenbe@fam.tuwien.ac.at

Personal Website

Research areas:

- Actuarial Mathematics

- Stochastic Optimization

- Optimal Control Theory

- Reinsurance, Dividends, Capital Injections in Insurance Companies

- Pensions

eisenbe@fam.tuwien.ac.at

Personal Website

Research areas:

- Actuarial Mathematics

- Stochastic Optimization

- Optimal Control Theory

- Reinsurance, Dividends, Capital Injections in Insurance Companies

- Pensions

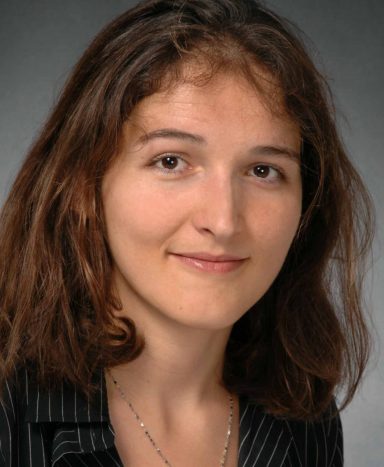

carole.bernard@vub.be

Personal Website

Research topics

- Systemic Risk.

- Decision Theory, Quantitative Behavioral Finance.

- Dependence Modelling, Assessing Model Risk.

- Volatility Derivatives, Quadratic Variation Hedging, Timer Options.

- Optimal Insurance and Reinsurance.

- Pricing and Hedging Exotic Derivatives: Barrier Options, Parisian Options.

- Applications of the Option Theory: Bank Deposit Guarantees, Regulation, Market Value.

- Valuation of Life Insurance Contracts.

- International Accounting Standards (IAS), IFRS, Solvency II.

- American Products, Surrender Option.

- Risk management, Economic capital, Risk measures: Value-at-Risk.

carole.bernard@vub.be

Personal Website

Research topics

- Systemic Risk.

- Decision Theory, Quantitative Behavioral Finance.

- Dependence Modelling, Assessing Model Risk.

- Volatility Derivatives, Quadratic Variation Hedging, Timer Options.

- Optimal Insurance and Reinsurance.

- Pricing and Hedging Exotic Derivatives: Barrier Options, Parisian Options.

- Applications of the Option Theory: Bank Deposit Guarantees, Regulation, Market Value.

- Valuation of Life Insurance Contracts.

- International Accounting Standards (IAS), IFRS, Solvency II.

- American Products, Surrender Option.

- Risk management, Economic capital, Risk measures: Value-at-Risk.

emmanuel.gobet@polytechnique.edu

Personal Website

Main research topics:

- Monte Carlo simulations and stochastic approximations

- Machine learning, data science, extremes

- Quantitative finance, risk management, digital finance

- Stochastic control and stochastic modelling

- Applications: Climate change, Energy

emmanuel.gobet@polytechnique.edu

Personal Website

Main research topics:

- Monte Carlo simulations and stochastic approximations

- Machine learning, data science, extremes

- Quantitative finance, risk management, digital finance

- Stochastic control and stochastic modelling

- Applications: Climate change, Energy

t.kleinow@uva.nl

Personal Website

Kleinow studied mathematics at Humboldt-Universität zu Berlin and received his degree in 1998. He later obtained his PhD in Economics from the same institution. From 2004 to 2010 he worked as a lecturer at Heriot-Watt University’s Department of Actuarial Mathematics and Statistics in Edinburgh and since 2010 he worked here as an associate professor. During his academic career Kleinow has supervised PhD students, held various administrative roles, and he continues to participate in many national and international research projects dealing with mortality rates and life expectancy.

t.kleinow@uva.nl

Personal Website

Kleinow studied mathematics at Humboldt-Universität zu Berlin and received his degree in 1998. He later obtained his PhD in Economics from the same institution. From 2004 to 2010 he worked as a lecturer at Heriot-Watt University’s Department of Actuarial Mathematics and Statistics in Edinburgh and since 2010 he worked here as an associate professor. During his academic career Kleinow has supervised PhD students, held various administrative roles, and he continues to participate in many national and international research projects dealing with mortality rates and life expectancy.

caroline.hillairet@ensae.fr

Personal Website

Research interests:

- Cyber risk : : Co-director of the Research Initiative : "Cyber insurance : actuarial modeling" coordinated by the Fondation du risque (Institut Louis Bachelier), and supported by AXA Research Fund

- Dynamic utilities and long term yield curve modeling

- Longevity risk and pensions

- Asymmetric information and enlargement of filtrations

- Principal-agent contract with moral hazard, Public-Private-Partnerships

- Credit Risk

caroline.hillairet@ensae.fr

Personal Website

Research interests:

- Cyber risk : : Co-director of the Research Initiative : "Cyber insurance : actuarial modeling" coordinated by the Fondation du risque (Institut Louis Bachelier), and supported by AXA Research Fund

- Dynamic utilities and long term yield curve modeling

- Longevity risk and pensions

- Asymmetric information and enlargement of filtrations

- Principal-agent contract with moral hazard, Public-Private-Partnerships

- Credit Risk

Fima.Klebaner@monash.edu

Personal Website

Research areas of interest are:

- Stochastic Processes

- Applied Probability

- Stochastic Calculus

- Financial Mathematics

- Mathematical Biology

- Population Dependent Branching Processes

Fima.Klebaner@monash.edu

Personal Website

Research areas of interest are:

- Stochastic Processes

- Applied Probability

- Stochastic Calculus

- Financial Mathematics

- Mathematical Biology

- Population Dependent Branching Processes

Contact Us

Send Message

If you have any questions or just want to get in touch, use the form below. We look forward to hearing from you!